What is IR35?

And what steps do I need to take to ensure that I am compliant?

The Intermediaries Legislation (IR35) was introduced in 2000 and aimed to remove the tax advantage of providing services via a limited company where it could be proved that were it not for the limited company, the actual business relationship between the contractor and the hiring organisation would be one of employment.

What’s changing?

The underlying rules themselves will remain the same, what will change is the responsibility for assessing IR35 status will move from the individual limited company / PSC to the hiring organisation (the end client), and the responsibility from making the deductions and payments of tax and national insurance contributions will move to the recruitment business or hiring organisation that pays the limited company. This change has already taken place within the public sector and was confirmed to be extended into the private sector in April 2020.

Due to the COVID-19 pandemic, this is now planned to be extended into the private sector in April 2021.

The key difference is that the public sector reform was a blanket approach, whereas the private sector reform is to only affect ‘medium’ and ‘large’ businesses. The ‘small’ businesses that will be exempt from the new responsibilities have been defined as;

• Turnover of £10.2 million or less.

• £5.1 million or less on its balance sheet.

• 50 employees or less.

It’s important to note, the size of the business relates to the hiring organisation that the contractor is providing services to, not the recruitment business that is sourcing the work and making the payments.

If the hiring organisation is ‘medium’ or ‘large’ and the assignment is deemed by them to be ‘Inside IR35’, the new legislation will require the business making the payment (usually a recruitment business) to pay a deemed employment payment to the limited company, making deductions for employers national insurance, employees national insurance and income tax. The limited company/PSC then pays the remaining net amount to the worker as a salary or dividend.

Where did these changes come from?

The introduction of the off-payroll legislation in the public sector in 2017 led to a rise in schemes available which are quite simply, not compliant. These can leave contractors or workers open to personal liabilities on tax. Where recruitment businesses or hiring organisations are recommending these schemes, the Criminal Finance Act is applicable and can result in very large fines and criminal proceedings.

This rise in schemes include a large number that claim to save the recruitment business or hiring organisation money from their employment costs or the end workers tax, but are essentially tax avoidance schemes. Basically, if it seems to good to be true, it probably is!

From April 2021, for any contracts that are deemed to be inside IR35, the safest solution will be to either work through your employment business’ staff payroll if it is an option or continue to work as a contractor but through a PAYE umbrella company. There are a number of umbrella companies out there that take compliance seriously and Fair Pay Services are one of them. We have strict systems and processes to ensure that all relevant deductions are made and submitted to HMRC each week via real time information (RTI). This greatly reduces the risk of any unexpected tax bills or demands for payment from HMRC as seen last year with the controversial enforcement of the loan charge.

What is an umbrella company?

An umbrella company is an employer of contractors and freelance professionals who complete different assignments at various locations for recruitment businesses and/or hiring organisations.

The umbrella company enters into an employment contact with the worker, and a service contract with the recruitment business or hiring organisation. As a contractor, by ensuring that you are dealing with a reputable organisation that is making the correct deductions, you are protecting your yourself from any challenges for unpaid tax and potential criminal proceedings for tax evasion.

Larson Howie Specialist Insurances and IR35 Advice

What if I don’t agree with HMRC’s outcome?

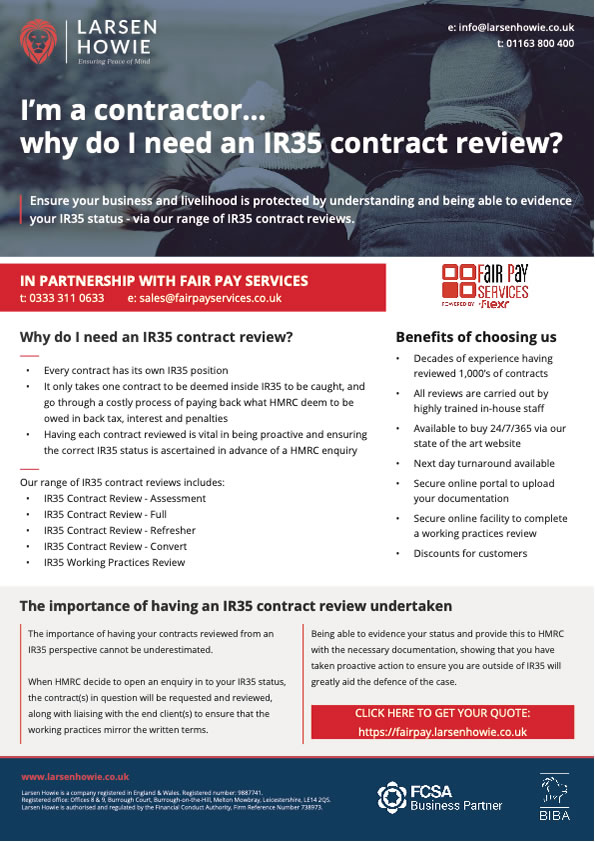

If you don’t agree with the outcome of the CEST tool, it is likely that the end client that you work for will make the same determination of your status. You will be able to challenge the determination with the end client but there are companies that can help you to do this.

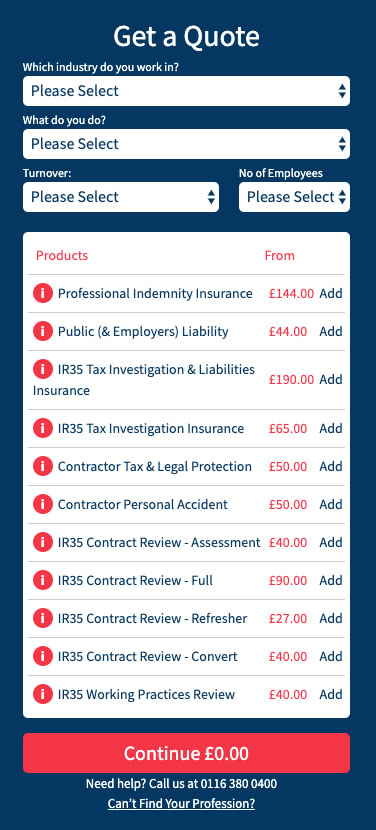

We have partnered with Larson Howie who specialise in IR35 Contract Reviews and provide insurance should your position subsequently be challenged by HMRC. You can view their services by clicking the image or View Services button;

Larsen Howie is a provider of specialist insurances and services, including Professional Indemnity cover and IR35 advice, to contractors, freelancers and consultants.

They offer Professional Indemnity, Public (& Employers) Liability, Contractor Liability, Contractor Tax & Legal Protection, IR35 Insurances, Contractor Personal Accident Insurance, as well as a range of IR35 Contract Reviews, including an IR35 Working Practices Review.

They ensure that their Professional Indemnity and Public (& Employers) liability insurances are amongst the most comprehensive and competitively priced on the market – after all, your hard-earned business success deserves to be protected.

To keep abreast of changes and updates within the contracting world, you can click the link below to visit Larsen Howie’s Knowledge Hub which has a wealth of information and is constantly being updated and added to.

Let's GET IN TOUCH

Please call or email now to find out more!

Payroll Enquiries / Customer Services (Option 1)

Mon-Fri 8am-8pm

[email protected]

New Registrations (Option 2)

Mon-Fri 8am-8pm

[email protected]

Out of Hours

Outside of our opening hours, you can leave a voicemail which will be actioned by the relevant team as soon as we open. If you have an urgent out of hours query, please send an email to [email protected] and we will do our best to assist you.