Invoice Finance / Back Office Support

We work with a number of trusted partners who can assist you with many areas of operation within your business. We have detailed common areas of support that we are asked about. If you would like to find out more or would just like a referral to a relevant partner, please contact us on 01604 360222 or [email protected]

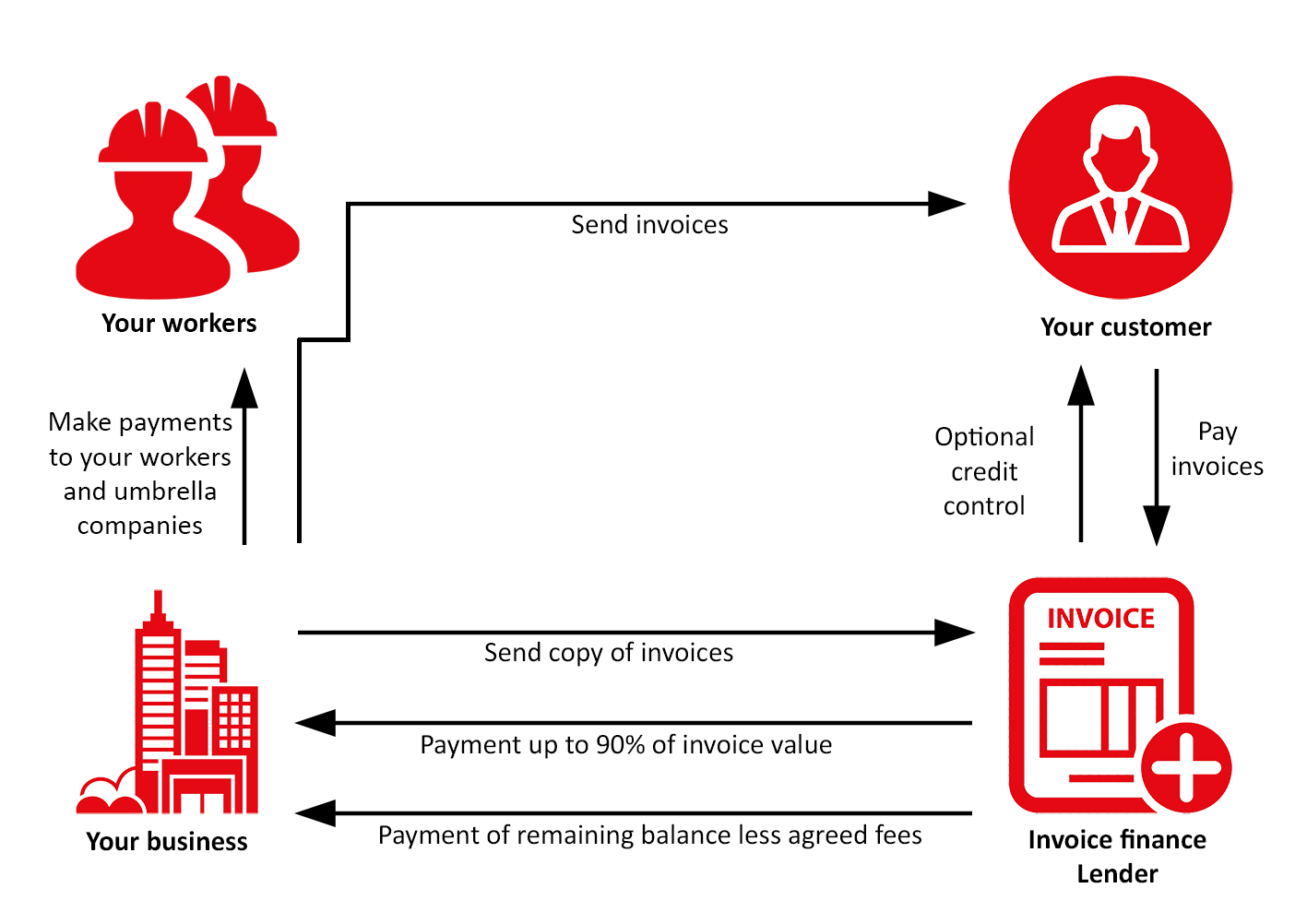

Invoice Finance

Invoice Finance allows you to unlock the value in your outstanding invoices ensuring a predictable cash-flow and peace of mind. Depending on the level of involvement from the funder, these facilities can be known as Factoring, CHOCS (Client Handles Own Collections), or CID (Confidential Invoice Discounting). The fees payable will vary dependant on the facility you choose and the size of your turnover.

- Early access to cash; you can generally release up to 90% of the cash tied up in your unpaid invoices, usually within 24 hours.

- In-depth industry knowledge; the businesses that we work with understand the complexity of the recruitment sector, and will ensure the right funding is provided.

- Dedicated Client Manager; funders will have a dedicated Client Manager to ensure that your needs are met.

- Predictable cash-flow; enabling you to focus on running your business and plan ahead more confidently.

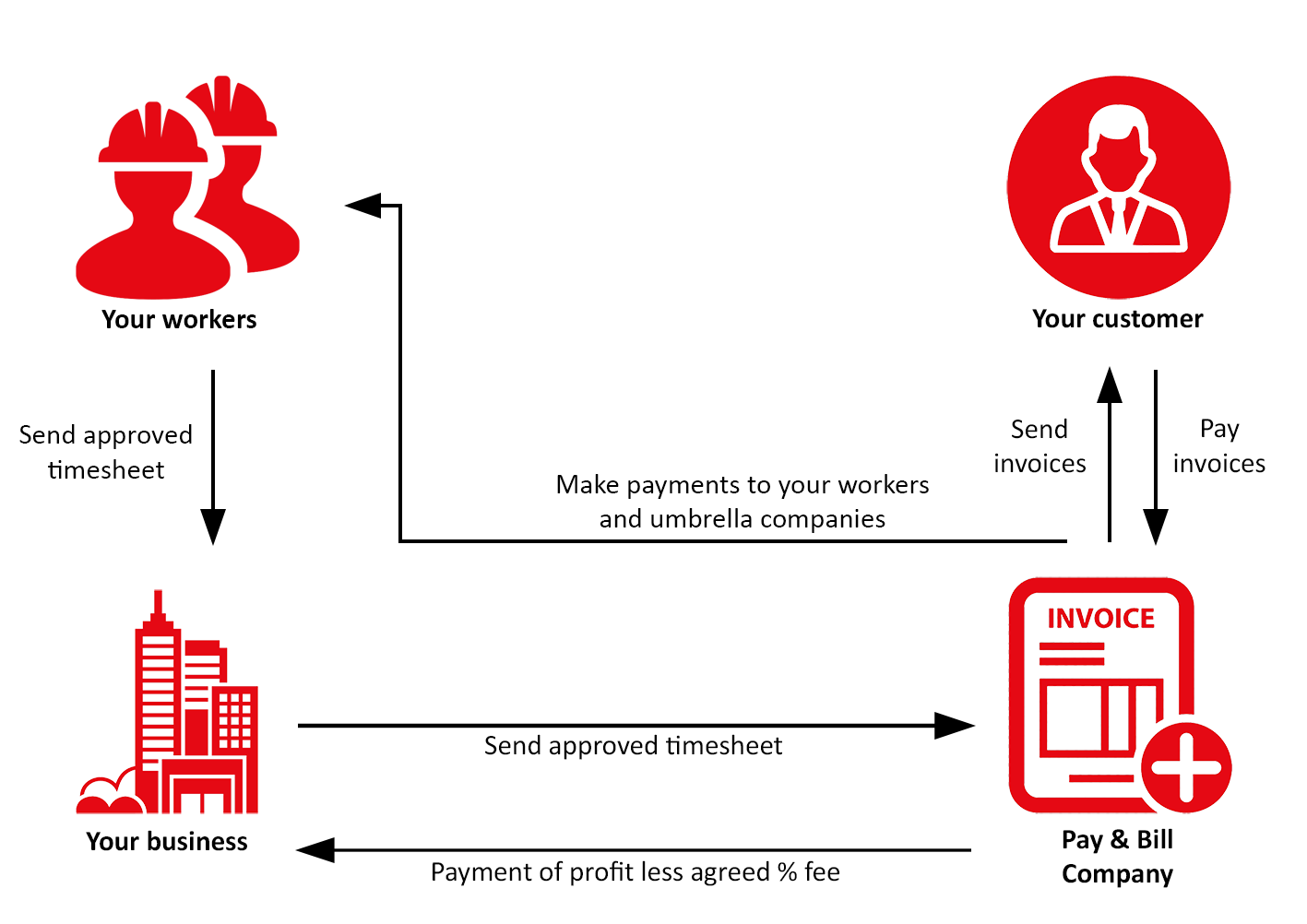

Pay & Bill

We work with a number of providers in this area and they tend to be more “hands on”, so sometimes more suitable for new start recruitment businesses. Their fees tend to be higher than the invoice finance only models, due to the added complexity of essentially being embedded in your business.

- Higher advance percentages; you can generally release up to 100% of the cash tied up in your unpaid invoices, minus the agreed % fee that they retain for their services.

- Software included; some providers will have software included in the deal which will make it more attractive to a new start business. This can help with keeping track of your temps / contractors, through to electronic timesheet systems.

- Dedicated Client Manager; you will more than likely have a dedicated Client Manager to ensure that your needs are met, along with day to day payroll contacts.

- Predictable cash-flow; enabling you to focus on running your business and plan ahead more confidently.

Back Office Support

Whether you’re starting a new recruitment agency or you’re considering changing your back office provider, we can refer you to a number of businesses with experience in this area. Some will provide back-office services only, whereas others will provide back office services, along with invoice funding. This is also sometimes known as a Pay & Bill model as detailed above.

- Act as your own internal team; a back office service provider will act as your own internal back office team. They will answer calls and emails in your company name and work to the agreed service levels.

- Free your time up; by working with an experienced back office provider, you will be free to do what you’re good at. Place workers and make money!

- Ensure compliance; experienced back office providers will ensure that you are working compliantly, and keep you ahead of any changes in regulations etc…

- Professionalism; working with an experienced back office provider will project professionalism and give your clients confidence that they are working with a well established business.

Outsourced PAYE Payroll

Whether you’re interested in outsourcing just your internal PAYE staff payroll or your entire temp / contractor PAYE payroll, we can advise and assist. There are lots of things to consider if you run PAYE internally, so outsourcing could save a lot of headaches and issues further down the line.

- Save on software licences and training; by outsourcing, you will remove the need to purchase and licence your own payroll software, and the time / cost in training somebody to operate it correctly.

- Predictable pricing; you will generally pay a per payslip / per pay period cost for outsourcing your PAYE payroll. This is a predictable and scalable way to manage cost and fluctuations in demand.!

- Payroll legislation; This is a constantly changing area. By outsourcing your internal PAYE, you will be kept up to date by your provider. They will deal with changes in deduction rates, thresholds, monthly PAYE returns and advise of liabilities and payments required to HMRC. They will also look after the auto-enrolment pension scheme, including enrolments, reporting and legislative changes.

- IR35 Compliance for temps / contractors; by outsourcing your internal PAYE and also working with an accredited PAYE Umbrella company, you can ensure full IR35 compliance. Whichever model each worker is paid by, UK PAYE & NIC’s will be correctly administered, removing your IR35 risk.