by Jimmy Holt | Jul 15, 2024 | Compliance

Supply teachers generally don’t expect the school to pay for their services unless they actually work, and many assume this means they’re not entitled to sick pay, but the truth is that many are entitled to claim. In fact, for teachers who are employed by an umbrella...

by Jimmy Holt | Jul 9, 2024 | Compliance

The National Minimum Wage (NMW) and National Living Wage set out the minimum hourly rate a UK worker must receive. It’s important to ensure that your contractors are paid at least this amount, so in this article we’ll look at how umbrella company pay interacts with...

by Jimmy Holt | Jul 4, 2024 | Compliance

It’s more important than ever for recruitment agencies to ensure compliance with all relevant legislation, and it can be difficult to keep up with all the requirements, so in this article we’re looking at what recruiters need to know about the Employment...

by Jimmy Holt | Jul 3, 2024 | Compliance

Many supply teachers will only be paid when they’re working but this situation is slightly different for umbrella company employees. In this article we’ll look at how employment with an umbrella company can help supply teachers to cover their time off. Use...

by Jimmy Holt | Jul 2, 2024 | Compliance

We know the school summer holidays come with additional expenses for many of our employees, and that’s exactly what Your Discounts is designed to help with. In this article we’ll look at some of the deals you can find in your Fair Pay Companion portal or app. These...

by Jimmy Holt | Jul 1, 2024 | Compliance

If you’re employed by an umbrella company, the payroll process will be slightly different from what you might be used to as a conventional employee, mostly because the supply chain involves other companies. The exact process will vary depending on your umbrella...

by Jimmy Holt | Jun 27, 2024 | Compliance

A general election always holds the possibility sweeping change, whether you see that as a promise or a risk, and employment legislation is often a prime target. In this article we’re looking at the manifesto promises from the three main parliamentary parties, so you...

by Jimmy Holt | Jun 26, 2024 | Compliance

If your recruitment agency engages contractors, there’s a good chance that it also works with umbrella companies on a regular basis and you may have considered using a Preferred Supplier List (PSL) to help you streamline the management of your umbrella contractors. In...

by Jimmy Holt | May 22, 2024 | Compliance

Getting your contractors registered with an umbrella company should be relatively simple, but there are some things that the umbrella absolutely must do before they can pay your contractors for the first time, even if they result in frustrating delays. In this article...

by Jimmy Holt | May 17, 2024 | Compliance

If you’ve engaged overseas contractors on a skilled worker visa, there are some recent changes that you need to be aware of. The main effect is to make it easier for workers to take additional work, once the conditions of their sponsorship are met. In this article...

by Jimmy Holt | May 13, 2024 | Compliance

At Fair Pay Services, we’re determined to be a powerful positive force in the lives of our umbrella employees. Part of that just involves doing what you expect of us – paying you correctly and on time, supporting you as your employer and getting all the “basics”...

by Jimmy Holt | May 10, 2024 | Compliance

Investing in your future has always been a good idea, and pensions are an obvious way to start. The earlier you start saving, the easier it will be to give your future self the gift of a comfortable retirement, so in this article we’re looking at the question of how...

by Jimmy Holt | May 7, 2024 | Compliance

The question of when our employees will be paid is by far the most common query we receive, just because it’s so important to contractors to know when to expect their money. In fact, in our experience, predictable pay is the answer to most of the stress in most...

by Jimmy Holt | Apr 24, 2024 | Compliance

Because of the way contractors work, umbrella company employees are sometimes paid more than once in a single tax period and this can make your payslips more complicated to read. In this article we’ll look in detail at the situation, so you’re prepared when and if it...

by Jimmy Holt | Apr 23, 2024 | Compliance

The new tax year started on 6th April 2024, and in this article, we’ll detail the things that Fair Pay Services employees might need to know. PAYE tax rates and allowances Personal allowances for PAYE tax and the primary threshold for National Insurance Contributions...

by Jimmy Holt | Apr 23, 2024 | Compliance

If you’re currently engaging your contractors directly through Agency PAYE, there are a number of good reasons to outsource employment to a specialist expert. In this article we’ll look in detail at two popular models for doing this; umbrella company employment, and...

by Jimmy Holt | Apr 23, 2024 | Compliance

Industry accreditations can make it much easier for recruiters to ensure their umbrella company partners are both competent and compliant, but only if they understand the detail behind the badge. In this article we’ll look at the most common industry accreditations...

by Jimmy Holt | Apr 23, 2024 | Compliance

Umbrella company employment is one of the three main operating models available to contractors, and it’s a popular choice. In this article we’ll look at why your contractors might choose umbrella employment, so you can advise them more easily. Continuous employment:...

by Jimmy Holt | Mar 25, 2024 | Compliance

The recruitment and contracting industries often discuss tax compliance in a fairly negative, cautionary way, citing the potential consequences for recruiters and contractors if they get involved in tax avoidance. It’s important to understand why tax avoidance is a...

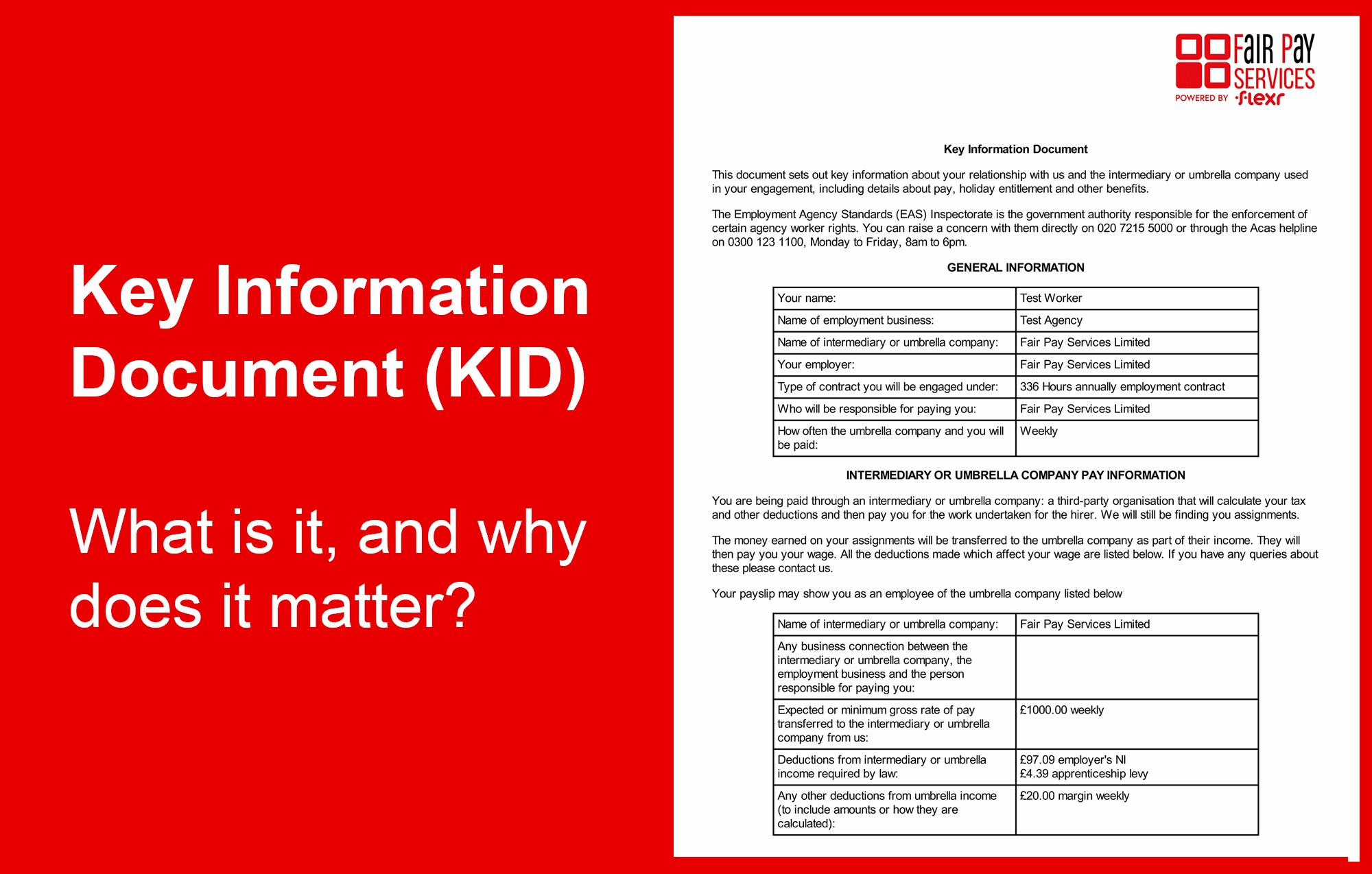

by Jimmy Holt | Mar 18, 2024 | Compliance

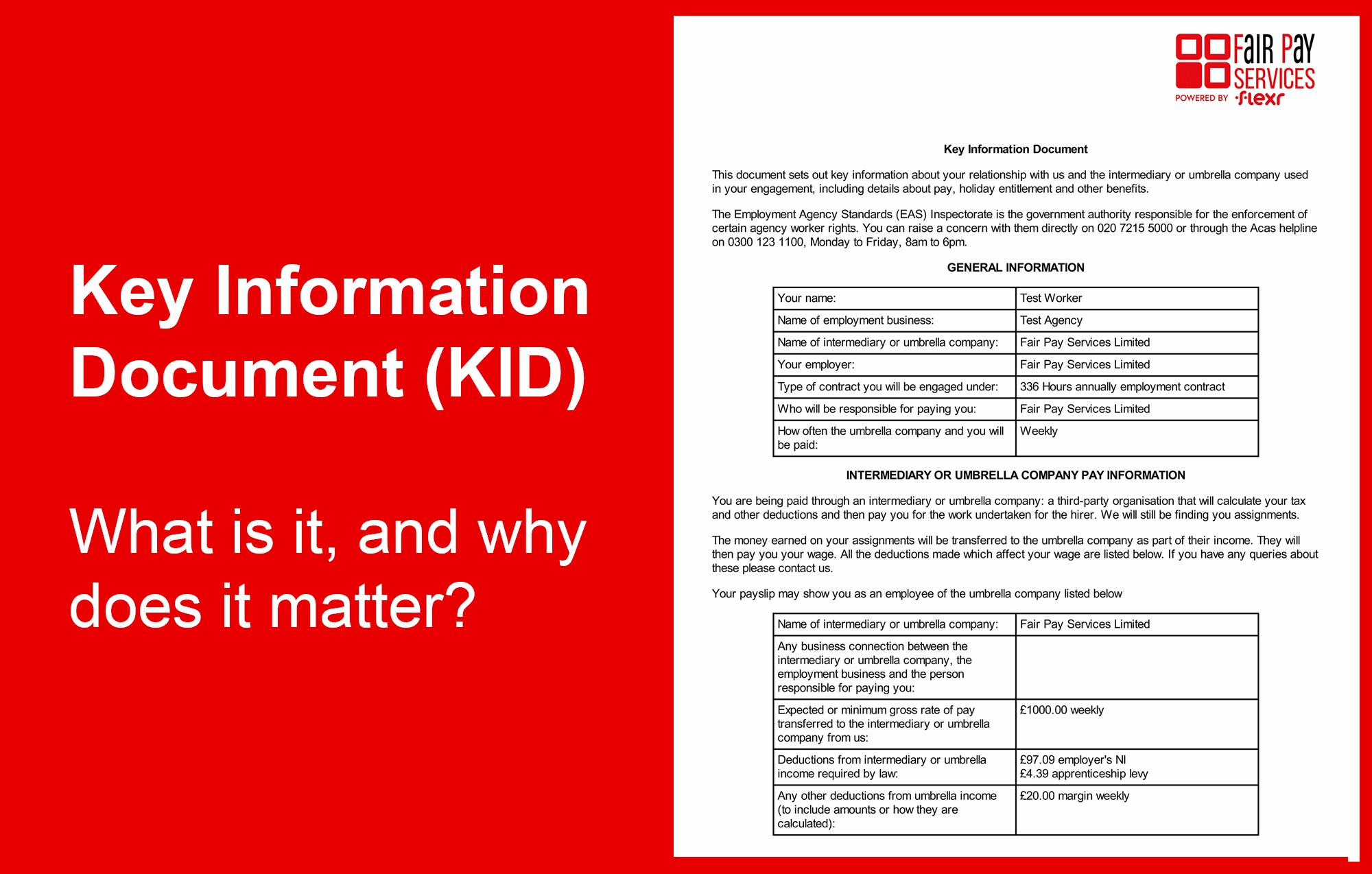

Since April 2020, each new candidate must be supplied with a Key Information Document outlining the details of their engagement, including how they are engaged and an estimate of their take home pay. Despite this being a legal requirement for years now, many...

by Jimmy Holt | Mar 11, 2024 | Compliance

From a recruiter’s point of view, umbrella companies employ your contractors, charge you a fee for the work they complete, and pay them as their employees out of that fee. The fee you pay includes the umbrella’s profit margin and costs, which means the contractor will...

by Adam Holby | Jan 11, 2024 | Compliance

As a recruiter, you may see healthcare workers who want to contract through their own Limited company, often called a Personal Service Company, or PSC. The expectation is that as the director and shareholder of a PSC they can take advantage of tax-planning...

by Adam Holby | Nov 21, 2023 | Legislation

The minimum wage will increase by more than a pound to £11.44 per hour from April next year. The minimum wage, known officially as the National Living Wage, varies according to the age of the employee and is currently £10.42 an hour for workers over 23. For the...

by Adam Holby | Sep 14, 2023 | Compliance

We recently attended a webinar with GLAA, EAS and HMRC a number of government departments, covering the following areas for Employment Businesses; Due Diligence Mini Umbrella Company Fraud Key Information Documents National Minimum Wage (NMW) Risks We’ve summarised...

by Adam Holby | Sep 1, 2023 | Compliance

🚨 Important Announcement: New Measures to Combat Illegal Migration 🚨 To further emphasise the importance of carrying out Right to Work checks correctly, we’ve summarised some key points from a recent article – Click Here to Read Full Article In a significant...

by Adam Holby | Jul 30, 2023 | Compliance

How much will I be paid if I work through an Umbrella Company? If you are paid by an Agency / Employment Business directly, then the rate it offers you (commonly known as the PAYE rate) is the amount, before your PAYE Income Tax and Employees National Insurance...

by Adam Holby | Jul 30, 2023 | Compliance

A KID should be the first document you receive from the recruitment agency looking for temporary work for you. This type of recruitment agency is known as an ‘employment business’. The KID should set out the key information about your relationship with the employment...

by Adam Holby | Jun 8, 2023 | Compliance

We recently attended APSCo’s Public Policy meeting with HMRC. The session covered Off-Payroll Working (IR35) – calculation of PAYE liability in cases of non-compliance and Tougher consequences for promoters of tax avoidance. We’ve summarised the points...

by Adam Holby | Mar 6, 2023 | Legislation

The Government has announced the National Living Wage – NLW (for those aged 23 and over) and the National Minimum Wage – NMW (for those of at least school leaving age) rates which will come into force from 1st April 2023. The National Living Wage will...

by Adam Holby | Dec 12, 2022 | Compliance, Legislation, Post Slider

You may have seen the government’s announcement that the adjustments to right to work (RTW) checks introduced on 30 March 2020 as part of the response to coronavirus (COVID-19), would finally end on 30 September 2022. The end date for the temporary adjusted checks had...

by Adam Holby | Nov 23, 2022 | Compliance, Post Slider

We are delighted to announce that we have now partnered with JobsAware. JobsAware provides free help and advice to UK workers who believe they might have suffered from job scams or unfair working practices. They resolve issues directly where possible, but where they...

by Adam Holby | Sep 30, 2022 | Compliance

Dave Chaplin – “Mr IR35” recently spoke to Julia Kermode from iWork about the governments shock announcement to repeal the off-payroll working legislation You can listen to the entire episode here...

by Adam Holby | Sep 9, 2022 | Compliance

Our thoughts and sympathies are with The Royal Family and all who mourn her. “I cannot lead you into battle. I do not give you laws or administer justice. But I can do something else. I can give you my heart and my devotion to these old islands and to all the...

by Adam Holby | Jul 4, 2022 | Legislation

On 23rd March 2022 in the Spring Statement 2022, the government announced an increase in National Insurance primary thresholds affecting the 2022 to 2023 tax year. These changes will take effect from 6th July 2022, resulting in employees paying National Insurance...

by Adam Holby | Feb 22, 2022 | Legislation

The Government has announced the National Living Wage (NLW) and National Minimum Wage (NMW) rates which will come into force from 1st April 2022. The National Living Wage will increase by 6.6 per cent from £8.91 to £9.50. From 1st April 2022, the National Living Wage...

by Adam Holby | Nov 12, 2021 | Compliance

With the UN Climate Change Conference – COP26 drawing to a close, we’ve teamed up with our partners at Flexr for an initiative to help balance our carbon emissions. For every worker registered with us before 31st December 2021, the team at Flexr have...

by Adam Holby | Aug 19, 2021 | Compliance, Legislation

There are 3 main operating models that you may have seen where it comes to PAYE Umbrella; Fixed Expenses Model Mileage Expenses Model Payroll Model For an in depth explanation of the 3 models, you can view an old but still relevant article by Contractor Calculator at...

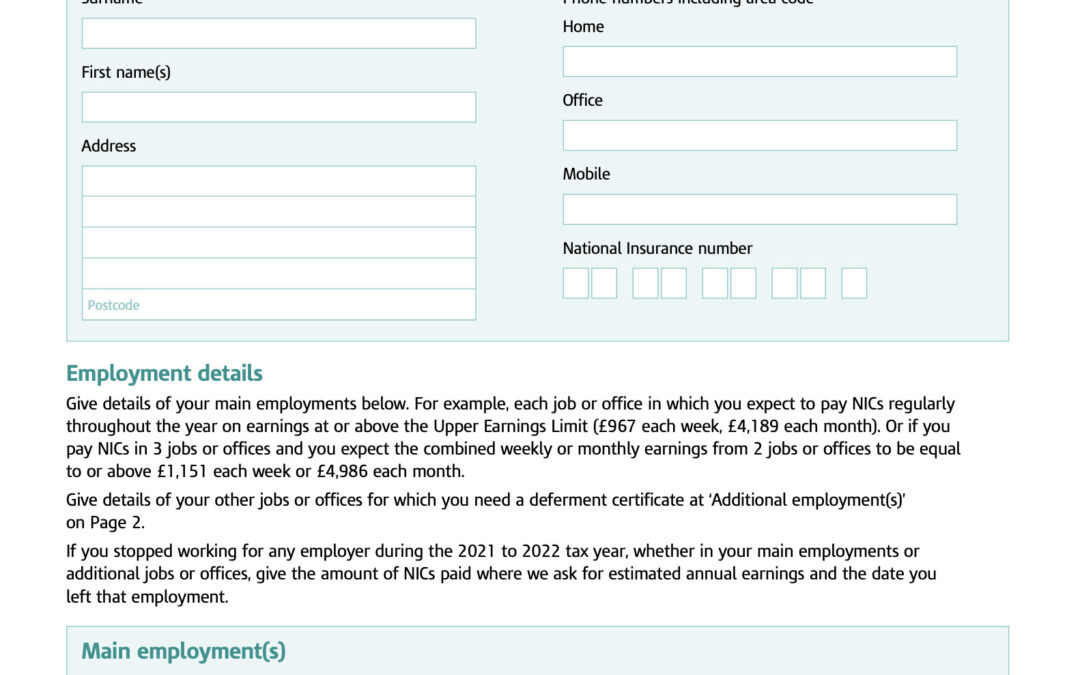

by Adam Holby | May 10, 2021 | Compliance

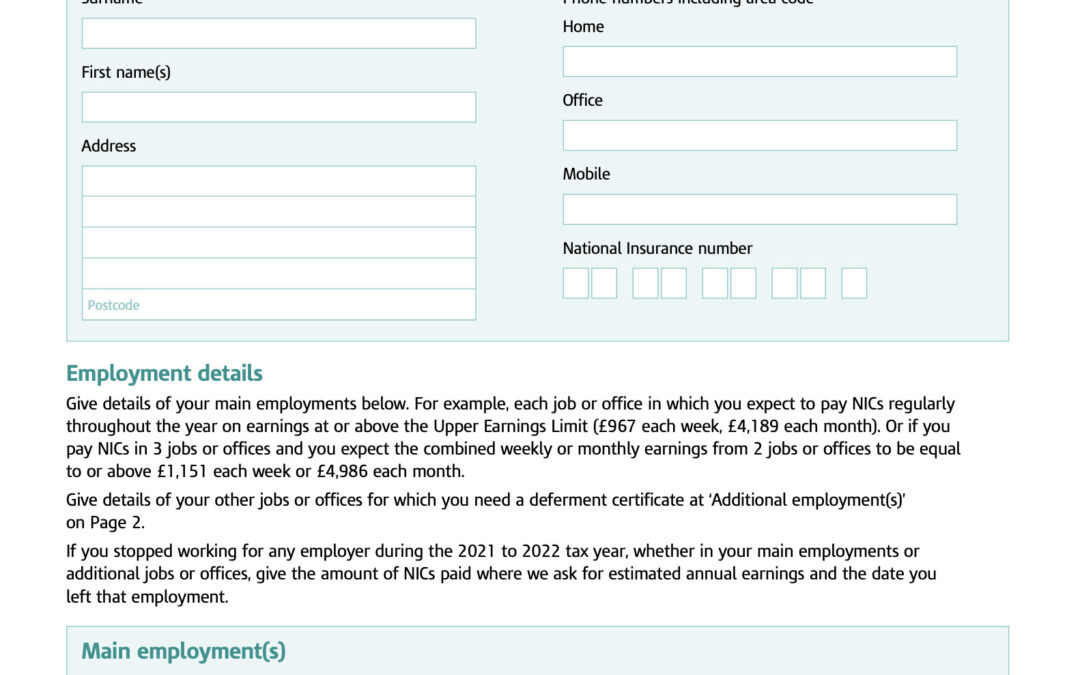

Did you know that employees with multiple jobs may be able to pay a lower rate of Employees NI if they are already paying their full quota through another employer? Employees must pay the standard rate of 12% on earnings between £184-£967 per week, thereafter the rate...

by Adam Holby | Feb 26, 2021 | Compliance

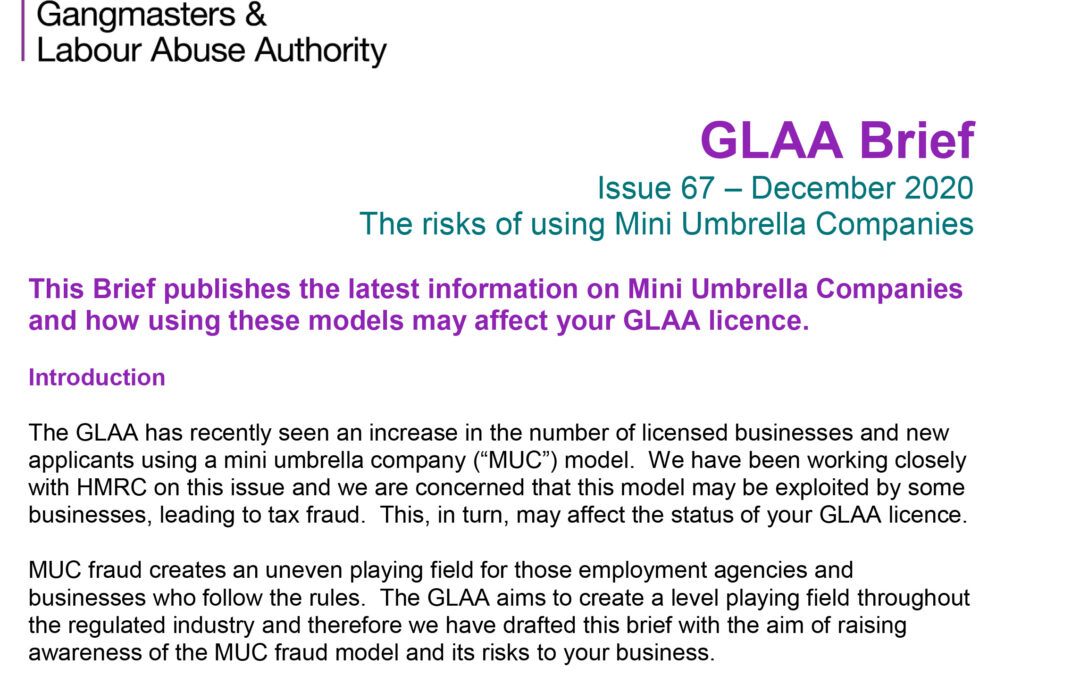

This briefing from the Gangmasters & Labour Abuse Authority highlights the risks of using Mini Umbrella Companies in your supply chain and how to spot them. This is a payment model that has been highlighted by HMRC and officially labeled as a tax-avoidance scheme....

by Adam Holby | Feb 11, 2021 | Legislation

If you deferred VAT payments due between 20th March and 30th June 2020 and still have payments to make, you now have options when it comes to repayments. You can: • pay the deferred VAT in full now • join the VAT deferral new payment scheme – the online service is...

by Adam Holby | Feb 5, 2021 | Legislation

There is just under a month to go until Wednesday 3rd March, when the government will publish the Budget. The annual Budget usually includes statements on pay, taxes, benefits and other financial issues. Last year’s Budget was very different to other years, as Rishi...

by Adam Holby | Jan 25, 2021 | Compliance, Legislation

EU, EEA or Swiss citizens currently employed to work in the UK can continue to do so despite Brexit. The Government’s EU Settlement Scheme was introduced to allow existing EU, EEA and Swiss citizens residing in the UK to continue living and working in the UK...

by Adam Holby | Dec 1, 2020 | Legislation

The Government has announced the National Living Wage (NLW) and National Minimum Wage (NMW) rates which will come into force from 1st April 2021. The National Living Wage will increase by 2.2 per cent from £8.72 to £8.91, and will be extended to 23 and 24 year olds...

by Adam Holby | Jul 20, 2020 | Compliance

In keeping with the House of Commons’ ‘financial privilege’ that the House of Lords will not amend a money bill, Finance Bill 2019-21 passed its second reading in the Lords on Friday. It then passed its committee stage, report stage and third reading as formalities in...

by Adam Holby | Jun 2, 2020 | Compliance

On Friday 29th May, the government announced some updates to the Coronavirus Job Retention Scheme and their plans around getting the country back to work. You can view the government’s published announcement here –...

by Adam Holby | May 5, 2020 | Compliance

Coronavirus has caused disruption for many business owners, leaving them struggling with finance and cash flow issues. The Coronavirus Business Interruption Loan Scheme (CBILS) has had an extremely low acceptance rate and due to the banks carrying a 20% risk of loss...

by Adam Holby | Apr 16, 2020 | Compliance, Legislation

The Coronavirus Act 2020 Functions of Her Majesty’s Revenue and Customs (Coronavirus Job Retention Scheme) Direction The Treasury, in exercise of the powers conferred by sections 71 and 76 of the Coronavirus Act 2020, give the following direction: 1. This direction...

by Adam Holby | Apr 7, 2020 | Compliance

Here are some aspects of the guidance that will be important to temp or contractor employment businesses / recruitment agencies: EMPLOYEES YOU CAN CLAIM FOR Only those workers who were on payroll on or before 28th February 2020 can be furloughed. What does this mean?...

by Adam Holby | Mar 27, 2020 | Compliance

You will no doubt have seen the recent government announcements around furloughing employees’ and the government covering the cost of this for 80% of their usual wages up to £2,500 per month. It seems pretty straight forward for your own recruitment consultants and...

by Adam Holby | Mar 26, 2020 | Compliance, Legislation

Coronavirus Job Protection Scheme The finer details of the scheme and eligibility of agency and umbrella company workers is still unclear. However, as a responsible employer, we felt it was time to take action. All workers that were registered with Fair Pay Services...

Recent Comments